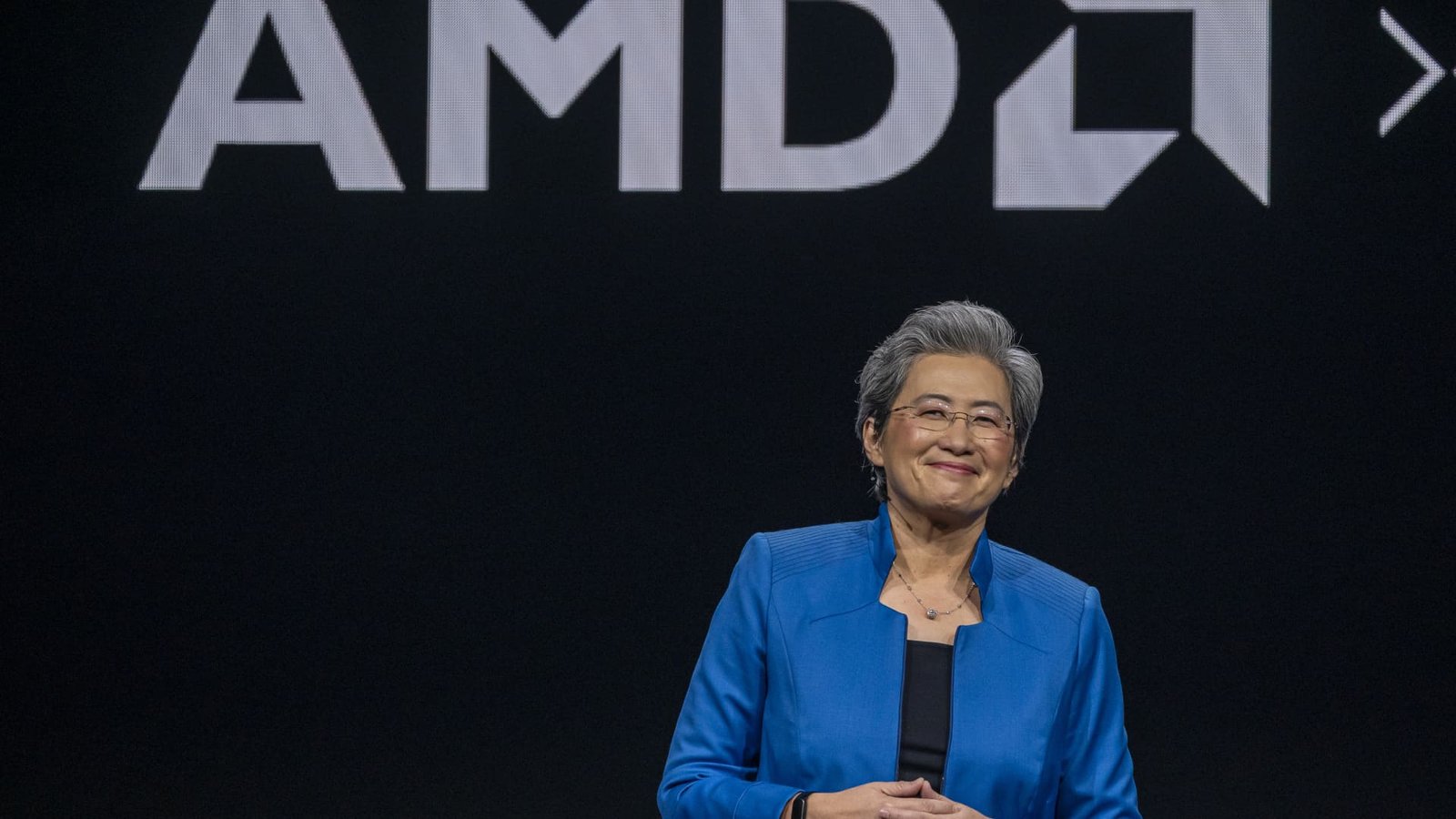

Every weekday, the CNBC Investing Club with Jim Cramer releases Homestretch — an actionable afternoon update, just in time for the final hour of trading on Wall Street. Markets: The S&P 500 rose to a new record high on Wednesday. There was no specific motivation for this move, but we are seeing a continuation of the theme we noted. With oil prices falling and the Chinese market giving up more of its recent gains, US stocks are free to rise. The market held on to gains after minutes of the Federal Reserve’s September policy meeting showed some disagreement among central bankers over how aggressively they should cut interest rates last month. The Fed ultimately opted for a massive 50 basis point cut to start the tapering cycle — with only one member of the policy committee officially voting in opposition. “Some participants noted that they would have preferred to lower the target range by 25 basis points at this meeting, and a few other participants indicated that they would have supported such a decision,” the minutes said. As of midday Wednesday, the market saw a roughly 80% probability of a 50 basis point cut in interest rates before the end of the year, according to CME Fed Watch. Movers: Financial companies have been leading the market higher, and it has been a good few days for them to return to the stronger than expected jobs report last Friday. Club name Morgan Stanley hit another multi-year high – and at session highs was a tick below the intraday record set in February 2022. Morgan Stanley exclaims earnings on October 16. Wells Fargo, our other bank, was flat the Wednesday before that. Earnings announcement Friday morning. There has been some strong follow-through at Honeywell after the industrial group on Tuesday announced plans to spin off its advanced materials business. CEO Vimal Kapoor explained the rationale for this rotation in an interview with CNBC’s “Squawk on the Street.” “We cannot achieve strong growth momentum if our investment portfolio is not healthy,” Kapoor said. “Expect more portfolio business to occur in 2025 and beyond,” he added. Chips: Semiconductor stocks were mixed with shares of Nvidia and Advanced Micro Devices falling slightly but Broadcom hitting a new all-time high. AMD is holding an Advancing AI event on Thursday, starting at noon ET. Last week, analysts at Bank of America said the offer could be a “catch-up catalyst” for the stock. After the company’s presentation with artificial intelligence technology last December, the stock rose by 19% within one month. AMD is expected to introduce new products at Thursday’s event, including the MI325 accelerator and the Turin CPU. But what seems up for debate are questions about future direction. Details on AMD’s product and roadmap are interesting, but the Street always wants to know what sales are being booked now. The Street appears to expect AMD to raise its full-year AI sales forecast to more than $5 billion, a $500 million increase given to management in July. The company’s ability to raise these expectations gave us the confidence to continue buying AMD when the market turned on AI stocks in early August. However, with earnings approaching toward the end of this month, analysts at Wedbush said Wednesday they believe management may wait until earnings to adjust guidance. After this year, one question Wedbush has is whether AMD will deliver on its 2025 AI sales target. They said the Street is targeting about $10 billion in sales next year, and their estimates are a bit higher than that number. Beyond guidance, Wedbush wants to know if AMD will announce another core customer for its AI chips. We know that big tech companies are hungry for computing power for AI workloads and that AMD can already claim that Oracle and Club name Meta Platforms and Microsoft as major customers. Wedbush is also interested in whether AMD will provide more information about the acquisition of ZT Systems, which was announced in August. Next: No big profits after Wednesday’s closing or Thursday’s opening bell. The CPI for September before the bell on Thursday is expected to show a continued deceleration in inflation, with consensus forecasting a 2.3% year-on-year increase from 2.5%. The Producer Price Index will be released on Friday. (See here for a complete list of stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you’ll receive a trade alert before Jim takes a trade. Jim waits 45 minutes after a trade alert is sent before buying or selling a stock in his charitable fund’s portfolio. If Jim talks about a stock on CNBC TV, he waits 72 hours after the trade alert is issued before executing the trade. The above Investment Club information is subject to our Terms and Conditions and Privacy Policy, as well as our Disclaimer. No obligation or fiduciary duty exists or is created by your receipt of any information provided in connection with the Investment Club. No specific results or profits are guaranteed.

Every weekday, the CNBC Investing Club with Jim Cramer releases Homestretch — an actionable afternoon update, just in time for the final hour of trading on Wall Street.